What is the Difference Between Digital Banking, Mobile Banking and Online Banking?

![Difference Between Digital Banking, Mobile Banking and Online Banking Difference Between Digital Banking, Mobile Banking and Online Banking]()

Online banking, mobile banking and digital banking are terms that are often used interchangeably, but they have distinct differences.

Online Banking:

Online banking is primarily about conducting traditional banking services over the internet. Customers can use a website to access their bank accounts, transfer money, pay bills, and check their account balances. It is centered on replacing physical branch tasks with an online counterpart. You generally need a computer with internet access to perform online banking tasks.

Digital Banking:

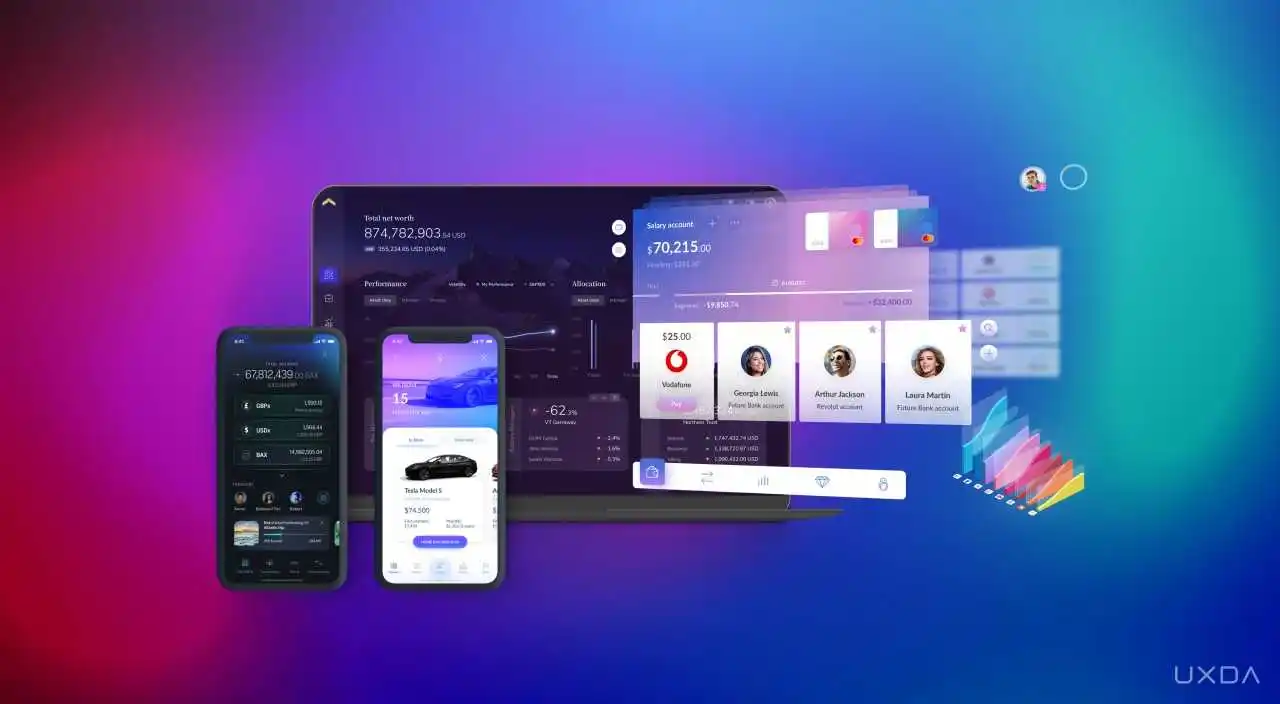

Digital banking encompasses online banking and expands on it. It refers to the digitization of all traditional banking activities and services that historically were only available to customers when physically inside a bank branch. Digital banking is broader and includes the use of digital technology like mobile banking apps, artificial intelligence (AI), data analytics, and more in its services. It's about a digital transformation that leads to new services and a more integrated customer experience across all devices - not limited to PCs, but also smartphones, tablets, and other devices.

Mobile Banking:

Mobile banking is another phrase that is often used interchangeably with online and digital banking. It is referred to as a service offered by a bank to its customers that allows them to do transactions using their mobile devices without having to visit a bank location.

Therefore, digital banking is more broad among the three concepts. It is safe to assume that it is a hybrid of online and mobile banking.

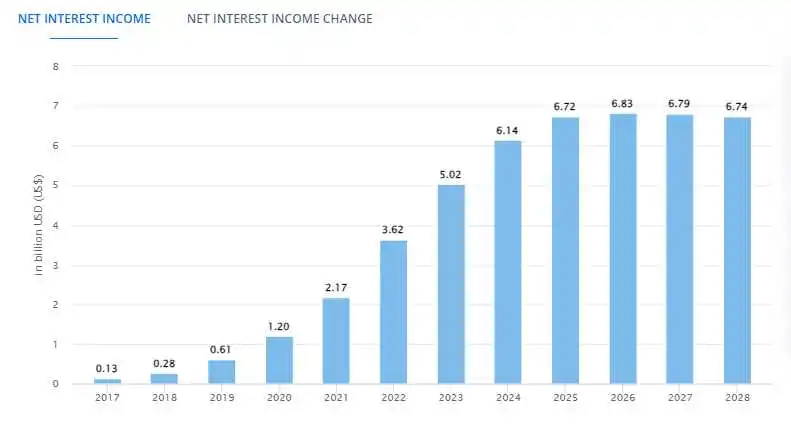

Digital Banking Sector Statistics

The digital banking sector is expected to keep on growing over the next five years due to the development and advancements of digital banking services.

![]()

People are becoming more comfortable with digital technologies and prefer to do their financial activities online, which is mainly what is driving the growth of digital banking. These days, digital banks are taking advantage of this trend by giving customers fast, easy, and handy mobile and online banking services.

What are Digital Banking Services?

Gone are the days of waiting in long lines at the bank. The digital era has brought banking to our fingertips, making financial management more accessible than ever. Digital Banking Services are revolutionizing the way we handle our money, offering a seamless blend of convenience and efficiency. From transferring funds to applying for loans, everything can be done with just a few clicks. But what exactly falls under the umbrella of digital banking services? Let's explore.

- Online Account Management

This service allows users to view their account balances, transaction history, and statements online. It's the backbone of digital banking, enabling customers to monitor their finances without visiting a bank.

- Mobile Banking Apps

Banks offer mobile applications that provide functionalities beyond what's available through their web platforms. Features include mobile check deposit, real-time alerts, and even budgeting tools, all from your smartphone.

- Electronic Funds Transfer (EFT)

EFT services enable the electronic transfer of money from one bank account to another. Whether it's paying bills or sending money to friends and family, EFT makes it quick and easy.

- Person-to-Person (P2P) Payments

With P2P payment services like Venmo or Zelle, sending money is as simple as sending a text. These services are integrated into many banking apps, streamlining transactions among individuals.

- Automatic Bill Payments

Forget about manually paying your bills each month. Automatic bill payment services deduct the amounts directly from your account, ensuring you never miss a due date.

- Remote Check Deposit

Deposit checks by taking a photo with your phone. This feature saves you a trip to the bank and makes funds available more quickly.

- Digital Wallets and Payments

Digital wallets like Apple Pay, Google Wallet, or Samsung Pay allow users to make purchases in stores or online without physical credit or debit cards. They provide a secure and convenient way to pay.

- Online Loan Applications

Applying for loans can now be done online. From personal loans to mortgages, digital banking services streamline the application process, often providing faster decisions.

- Investment Services

Many digital banking platforms now offer investment services, allowing users to buy stocks, bonds, or mutual funds directly through the app.

- Customer Support and Services

Digital banking includes various customer support options, such as live chat, email support, and AI-driven chatbots for 24/7 assistance.

Digital Banking Services have transformed the financial industry, making it easier for everyone to manage their money effectively. In an increasingly busy world, the convenience and efficiency offered by these services are invaluable. They not only save time but also provide enhanced security features, ensuring that users can bank confidently.

As technology continues to evolve, so will the features and capabilities of digital banking services, further simplifying the way we interact with our finances. In embracing digital banking, we're taking a step towards a more financially empowered future.

Now, let’s explore some of the best strategies you can use to promote your digital banking service or your mobile banking app.

Top 7 Digital Banking Marketing Strategies

![Digital Banking Marketing Strategies Digital Banking Marketing Strategies]()

Here's a look at the top 7 digital banking marketing strategies that can boost your brand and attract more customers.

1. Use Social Media Platforms

Social media is where the buzz is. By creating engaging content that showcases the ease and efficiency of your mobile banking services, you can connect with a broad audience. Use short, relatable videos and testimonials to highlight features, ensuring your message resonates with the modern consumer.

2. Utilizing Search Engine Optimization (SEO)

SEO is crucial for making your digital banking services visible online. By optimizing your website and content with relevant keywords, you can rank higher in search results, making it easier for potential customers to find you. Regularly updating your blog with helpful financial tips can also improve your SEO ranking.

3. Celebrity Visiting at Digital Banking Service Launch

A celebrity presence can significantly amplify your launch event's impact. When a well-known personality visits your digital banking service launch, it not only draws media attention but also builds trust and curiosity among potential customers. Ensure the celebrity’s image aligns with your brand values for maximum effect.

4. Celebrity Event for Your Digital Banking Conference

Organizing a conference with a celebrity can create a memorable impression. It’s an excellent opportunity to discuss future trends and how your services are at the forefront. This strategy can enhance your credibility and showcase your commitment to innovation in the mobile banking marketing arena.

5. Email Marketing

Send personalized emails to your prospects and customers with updates, offers, and educational content. Email marketing is a direct channel to engage with your audience, providing them valuable insights into managing their finances better with your digital banking solutions.

6. Referral Programs

Word-of-mouth is still one of the most effective marketing strategies. Implementing a referral program that rewards your existing customers for bringing in new ones can lead to organic growth. It’s a win-win; your customers get rewards, and you gain trustful leads.

7. Interactive Webinars

Hosting webinars on topics that interest your target audience can position your brand as a thought leader. Whether it’s about investment strategies or cybersecurity in digital banking, providing valuable information will build a community around your brand.

By implementing these digital banking marketing strategies, you can enhance your visibility, engage with your audience, and establish your brand as a leader in the digital banking space. Remember, the key is to be authentic, innovative, and customer-focused.

Best Tips for Digital Banking Branding

![Digital Banking Branding Digital Banking Branding]()

Here are five actionable tips that can guide your digital banking service or mobile banking application to be not just seen but remembered.

1. Craft a Unique Value Proposition

Your unique value proposition (UVP) is the heart of your branding. It should clearly communicate the unique benefits your digital banking service offers. Ask yourself, what makes your mobile banking application different? Is it unparalleled customer service, cutting-edge features, or perhaps a commitment to security? Highlight this in all your communications.

2. Develop a Consistent Visual Identity

Consistency is key in branding. Choose a color scheme, logo, and typography that reflects the essence of your digital banking brand and use it consistently across all platforms. This includes your app's user interface, marketing materials, and social media profiles. A recognizable visual identity makes your service memorable.

3. Engage with Storytelling

Storytelling connects emotionally with users. Share stories of how your digital banking service is solving real problems or improving financial health. Successful mobile banking application branding often involves customer testimonials and relatable scenarios that echo the user's experiences and aspirations.

4. Offer Stellar Customer Experience

Your brand reputation grows with every customer interaction. User-friendly design, personalized support, and seamless functionality are musts. Ensure that your mobile banking application is intuitive and your support team is easily accessible. A positive experience can turn users into brand ambassadors.

5. Utilize Educational Content

Empower your customers with knowledge. Producing educational content on financial wellness, the latest in digital banking security, or tips for managing finances can establish your brand as a helpful resource. Blogs, videos, and webinars are great ways to disseminate such content.

Implementing these strategies requires a thoughtful approach, but the rewards are many. By focusing on these aspects of digital banking branding, you can cultivate a brand that not only attracts but retains loyal customers in a highly competitive space.

Digital Banking Advertising Strategies You Should Be Using

![Digital Banking Advertising Digital Banking Advertising]()

Discover how to amp up your digital banking advertising game with these five effective strategies. From using influencers to creating campaigns that resonate, make sure your mobile banking application stands out from the crowd.

1. Targeted Social Media Campaigns

Dive into the world of social media with campaigns designed to meet your audience where they spend most of their time. Utilize data analytics to target potential customers based on their interests and online behavior. Craft unique, platform-specific content that educates users about your mobile banking services, all while encouraging interaction and shares.

2. Influencer Partnerships

Partner with influencers who can authentically represent your brand. The key is to choose individuals whose followers align with your target demographic. They can create relatable content that showcases the ease and functionality of your digital banking service, encouraging their audience to give it a try.

3. Search Engine Marketing (SEM)

Invest in SEM to ensure your mobile banking app appears at the top of search engine results when potential users are looking for banking solutions. Use strategic keywords related to digital banking to capture the attention of those already interested in services like yours.

4. User-Generated Content

Encourage existing users to share their experiences with your mobile banking application. Launch challenges or contests prompting them to post about a feature they love or how your app has simplified their life. This not only provides authentic content but also increases your brand’s reach.

5. Celebrity Video Ads

A high-impact strategy is creating video ads featuring celebrities. These ads can quickly grab attention and lend credibility to your digital banking service. When a trusted celebrity talks about how they use your mobile banking app in their daily routine, it can be a powerful endorsement, resonating with fans and potential users alike.

By deploying these strategies with creativity and consistency, you're setting the stage for a successful digital banking advertising campaign that captures interest, builds trust, and drives the adoption of your mobile banking app.

5 Ways for Digital Banking Promotion

![Digital Banking Promotion Digital Banking Promotion]()

Enhance your mobile banking promotion with seven savvy strategies that will capture attention and engage customers. Here's how you can integrate each of these dynamic methods for your digital banking service.

1. Instagram Reel on Celebrity Insta Account

Create a catchy Instagram Reel featuring a celebrity using your digital banking app in everyday life. This quick, engaging video can showcase app features, highlight ease of use, and display the convenience of your service. When shared by a celebrity, the reel has the potential to go viral, reaching a massive audience.

2. Instagram Post on Celebrity Insta Account

A well-crafted Instagram post on a celebrity’s account can create a buzz. Have the celebrity share a snapshot using your mobile banking application, accompanied by a personal testimonial. This creates a trust factor, as followers often value the recommendations of celebrities they admire.

3. Instagram Story by Celebrity on their Instagram Account

Short and sweet, an Instagram Story by a celebrity can offer a candid glimpse into how they benefit from your digital banking service. Since stories are temporary, they create a sense of urgency, prompting viewers to act quickly and check out your app.

4. Instagram Link in Bio of a Celebrity or Influencer

Placing a link to your digital banking app in a celebrity's Instagram bio is an excellent call-to-action. As fans explore a celebrity's profile, they find a direct link to your service, simplifying the journey from discovery to app download.

5. Celebrity Going Live on Instagram

When a celebrity goes live on Instagram to discuss your digital banking service, it creates an interactive experience. They can answer questions in real-time and demonstrate app features, generating excitement and a personal connection with their followers.

6. Referral Programs

Implement a referral program that rewards existing users for bringing in new customers. This word-of-mouth promotion feels more personal and can lead to higher retention rates.

7. Email Campaigns

Regularly send out personalized email campaigns with updates, offers, or educational content. Keep your digital banking service top of mind and nurture a relationship with your subscribers.

Utilizing these strategies can significantly boost the visibility and appeal of your mobile banking app. Keep it simple, authentic, and engaging, and watch your digital banking service grow.

Why Choose Celebrity Endorsement for Your Digital Banking Service or Mobile Banking App?

![Celebrity Endorsement for Your Digital Banking Service or Mobile Banking App Celebrity Endorsement for Your Digital Banking Service or Mobile Banking App]()

Celebrity endorsements have become a golden key for digital banking services aiming to make a mark in the fiercely competitive financial marketplace. Here are five undeniable benefits that come with having a star vouch for your digital bank.

1. Boosted Brand Awareness

When a celebrity partners with a digital banking service, their broad reach and influence can propel the brand into the spotlight almost overnight. Imagine a famous personality talking about your digital bank on their social media platforms. Their endorsement acts like a beacon, attracting attention and curiosity from millions of followers. This surge in visibility is invaluable, helping your brand break through the noise and capture the market's attention.

2. Enhanced Credibility

The backing of a well-respected celebrity adds a layer of trustworthiness to your digital banking service. People tend to put faith in the products and services used by their favorite stars. If a reputable figure is comfortable entrusting their financial transactions to your digital bank, it signals to potential customers that the service is reliable and secure. This perceived endorsement can significantly reduce the hesitation new users might feel towards trying out an online banking platform.

3. Wider Audience Reach

Celebrities naturally come with a diverse fan base, spanning different ages, interests, and demographics. By collaborating with them, digital banks can tap into these varied audiences, some of which may have been challenging to reach through traditional marketing channels. It’s a way to introduce your digital banking solution to potential customers who might not have discovered it otherwise.

4. Increased Consumer Engagement

Celebrity endorsements can spark conversations and drive engagement around your digital banking brand. Whether it's through a viral Instagram post, a tweet, or a YouTube video, content featuring celebrities tends to garner more likes, comments, and shares. This increased social media traction creates a buzz, keeping people talking about your service and, more importantly, considering it for their banking needs.

5. Differentiation from Competitors

In a sea of digital banking options, standing out becomes crucial. Celebrities can help position your brand as a preferred choice by showcasing what makes it unique. Whether it’s innovative app features, superior customer service, or unique rewards, a celebrity can highlight these aspects in a relatable and engaging manner. Their endorsement can be the distinctive factor that tips the scales in your favor among consumers making a decision.

From expanding brand awareness and credibility to engaging a wide audience and differentiating your brand in the market, the impact of celebrity endorsements is both powerful and far-reaching. It’s about creating a connection that resonates with potential customers, making your digital banking service not just known, but preferred.

Get Celebrity Endorsement For Your Digital Bank Now!

Imagine your brand being promoted by a beloved star. It's not just about fame; it's about trust. And now, with us, finding the perfect celebrity endorsement deal for your bank has never been easier.

![Priya Mani Raj.png]()

![Prem Chopra.png]()

![Daisy-Shah.png]()

Don’t miss out on this opportunity. Pick your star, and watch your digital bank become more popular than ever.

![button_talk-to-us.png Digital Banking Marketing with Celebrities]()

![birthday occasion]() Birthday Gifts

Birthday Gifts

![anniversary occasion]() Anniversary Gifts

Anniversary Gifts

![women]() Women

Women

![men]() Men

Men

![Couples]() Couples

Couples

![Couples]() Wedding Gifts

Wedding Gifts

Birthday Gifts

Birthday Gifts

Women

Women

Men

Men

Anniversary Gifts

Anniversary Gifts

Wedding Gifts

Wedding Gifts

We now support international payments

We now support international payments