Why Influencer Marketing Works in Fintech

1. Trust and Credibility

In the complex world of finance, consumers often struggle with the jargon and skepticism surrounding traditional institutions. Fintech influencers—many of whom have industry experience or specialized certifications—offer relatable, honest reviews and insights. Their credibility is bolstered by transparent personal experiences with digital banking tools, peer-to-peer lending platforms, or investment apps, making them trusted sources for millennial and Gen Z audiences.

2. Simplified Financial Concepts

Fintech products often involve intricate technologies like blockchain, artificial intelligence, or mobile-first banking solutions. Influencers excel at demystifying these concepts by breaking down complex topics—such as how robo-advisors optimize investment portfolios or how digital wallets ensure security—into clear, easy-to-understand content. This helps everyday consumers grasp the practical benefits and risks associated with modern financial products.

3. Engagement and Community Building

Fintech influencers frequently host live Q&A sessions, webinars, or interactive tutorials that directly address common financial challenges. These real-time engagements not only provide immediate value but also create a dynamic community of users who share tips and success stories. In fact, some campaigns in the fintech space have achieved engagement rates as high as 126%, highlighting how interactive, community-focused content can drive both learning and trust.

4. Targeted Reach

Unlike broad-spectrum advertising, fintech influencer partnerships allow brands to tap into specific audience segments. For example, an influencer specializing in cryptocurrency might reach young investors keen on decentralized finance, while another focusing on mobile banking might connect with users seeking simpler financial solutions. This precision targeting helps fintech brands efficiently reach niche markets that are most likely to benefit from—and invest in—their services.

5. Cost-Effective Strategy

With regulatory constraints and the high costs of traditional advertising, partnering with fintech influencers offers a budget-friendly alternative. These collaborations enable brands to leverage pre-established audiences and authentic storytelling, often resulting in higher conversion rates and brand loyalty. In many cases, the return on investment from these campaigns exceeds that of conventional marketing channels, making influencer partnerships a smart strategic choice in the competitive fintech landscape.

The Impact of Influencer Marketing on Financial Brands

Influencer marketing has become a pivotal strategy for fintech companies in India, enabling them to connect authentically with their target audiences. Here are some notable examples of successful fintech influencer campaigns in the Indian context:

1. Kotak Mahindra Bank's #SamayKoSahiKaamPeLagao Campaign

![Kotak Mahindra Bank's #SamayKoSahiKaamPeLagao Campaign Kotak Mahindra Bank's #SamayKoSahiKaamPeLagao Campaign]()

Kotak Mahindra Bank launched the #SamayKoSahiKaamPeLagao campaign to promote its zero-balance digital account, Kotak811. The campaign featured stand-up comedians Tanmay Bhat and Samay Raina, using humor to highlight how Kotak811's digital banking solutions allow users to save time. The ads emphasized the convenience of features like instant account opening and online video KYC, encouraging consumers to utilize their time more effectively.

2. HDFC Bank's #MoohBandRakho Campaign

HDFC Bank executed the #MoohBandRakho campaign to promote financial security and awareness. Featuring celebrities such as Gauhar Khan, Prajakta Koli, and Dhanashree Verma, the campaign garnered over 19 million views and more than 1.5 million engagements across various platforms within just two days of its launch.

The Future of Influencer Marketing in Fintech

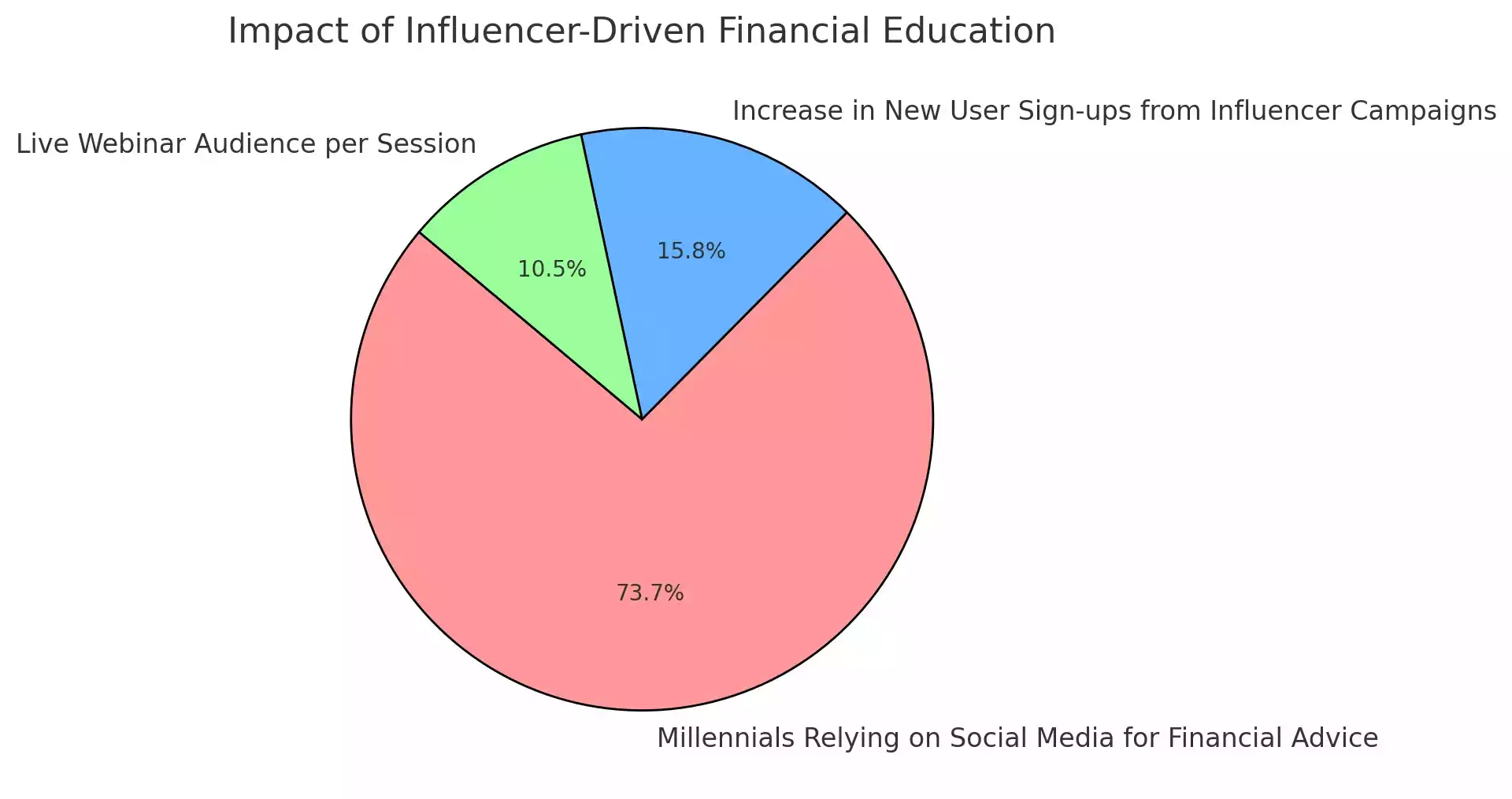

Recent studies indicate that nearly 70% of millennial consumers now rely on social media personalities for financial advice—a 25% increase over the past year. In response, fintech firms such as Cash App and Chime are launching influencer campaigns that feature monthly live webinars and interactive tutorials, attracting audiences of over 10,000 viewers per session. Early data from these initiatives points to a 15% rise in new user sign-ups, underscoring the measurable impact of influencer-driven financial education.

At the same time, tighter regulatory guidelines are prompting fintech brands to adopt rigorous standards for content accuracy and transparent disclosures. By instituting clear protocols for influencer partnerships, these companies are not only meeting consumer demand for factual, reliable financial information but also setting new benchmarks in marketing effectiveness.

Looking ahead, many fintech firms are planning to allocate a substantial portion of their digital marketing budgets to specialized, data-driven influencer projects. This focused investment aims to further refine content quality and directly address the unique challenges of communicating complex financial topics to a broad audience.

![Imapct of Influencer Driven Financial Education Imapct of Influencer Driven Financial Education]()

Get Influencer Marketing For Your Fintech Brand

Partnering with the right influencer can elevate your fintech brand, enhance credibility, and expand your customer base. We specialize in connecting financial brands with trusted influencers who can effectively communicate complex financial concepts in a relatable and engaging way.

From strategic influencer collaborations and educational content creation to high-impact endorsement campaigns, we manage every aspect of the partnership process. Our services include identifying finance-savvy influencers, negotiating collaborations, and developing compelling content that builds trust and drives engagement.

By leveraging influencer marketing, you can boost brand awareness, establish authority in the fintech space, and drive user sign-ups. A well-executed influencer campaign can simplify financial literacy for your audience, strengthen customer loyalty, and position your fintech brand as an industry leader.

![Talk To Us Talk To Us]()

![birthday occasion]() Birthday Gifts

Birthday Gifts

![anniversary occasion]() Anniversary Gifts

Anniversary Gifts

![women]() Women

Women

![men]() Men

Men

![Couples]() Couples

Couples

![Couples]() Wedding Gifts

Wedding Gifts

Birthday Gifts

Birthday Gifts

Women

Women

Men

Men

Anniversary Gifts

Anniversary Gifts

Wedding Gifts

Wedding Gifts

We now support international payments

We now support international payments